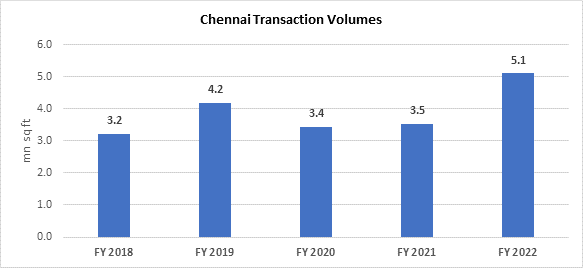

`Knight Frank India, an international property consultancy, in their latest report – ‘India Warehousing Market Report – 2022’, cited that Chennai recorded warehousing transaction volume of 5.1 mn sq ft in FY 2022, a substantial growth of 44% YoY compared to 3.53 mn sq ft in FY 2021.

Chennai, due to its proximity to the sea, became a desirable base for heavy industries-. Apart from serving as a home base to Automobile industry; textile production and manufacturers for heavy industries are among the other major industries driving the industrial and warehousing market in city.

WAREHOUSING TRANSACTIONS ACROSS TOP 8 INDIAN CITIES

FY 2022 | % Change | CAGR | |

| City | in mn sq ft | FY 2022 YoY | FY 2017-22 |

| NCR | 9.1 | 32% | 26% |

| Mumbai | 8.6 | 48% | 41% |

| Pune | 7.5 | 166% | 30% |

| Bangalore | 5.9 | 38% | 36% |

| Hyderabad | 5.4 | 128% | 35% |

| Ahmedabad | 5.3 | 81% | 25% |

| Chennai | 5.1 | 44% | 22% |

| Kolkata | 4.3 | 41% | 26% |

| Total | 51.3 | 62% | 30% |

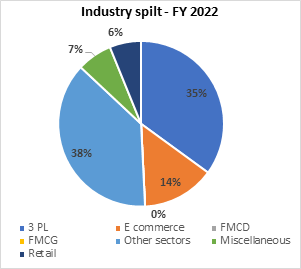

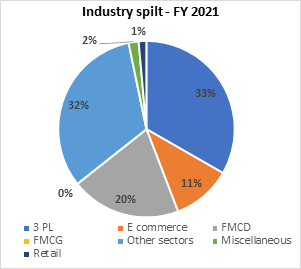

With respect to industry-split of transaction volume, manufacturing sectors (automobile, pharmaceutical, etc.) except FMCG and FMCD constituted to the biggest demand driver for warehouses. The sector accounted for 38% share of the region’s warehousing transactions, followed by Third Party Logistics (3PL) players with 35% share in FY 2022. E-commerce and retail players have been a recent addition to this list of warehousing demand drivers in the city. The retail sector witnessed significant increase in share of transaction volume from 1% in FY 2021 to 6% in FY 2022.

INDUSTRY-SPLIT OF TRANSACTION VOLUME